It’s a whole new world starting in November [2019].

— Netflix CEO, Reed Hastings, speaking at the Royal Television Society Conference in Cambridge, England on 20 September 2019 (O’Connell 46)

Netflix’s dozen-year run as the unassailable superpower in the brave new world of streaming is being seriously challenged for the first time beginning in late 2019 and now into early 2020. It currently remains the dominant player in the over-the-top (OTT) television and film sector, which for all intents and purposes, it initiated in 2007.

Even back then, NBC and Fox had Netflix in their sights when together they created Hulu in 2008. Disney soon joined them in 2009 where it presently operates as Hulu’s majority shareholder and an emergent streaming powerhouse in its own right with the launching of Disney+ on 12 November 2019.

Netflix was founded as a Silicon Valley startup in the summer of 1997 in Scotts Valley, California, moving its headquarters to nearby Los Gatos two years later. Fast forward to the 2010s where Netflix has gradually refocused more of its corporate attention and considerable financial resources southward 350 miles towards Hollywood.

Netflix only licensed and archived films and television programs for its subscriber base during its early years as a streamer. Then starting in 2011, Netflix expanded its purview by outbidding HBO for House of Cards (2013-2018), setting in motion an arms race in content creation that grows increasingly excessive and impractical with each passing year.

Fig. 1: Netflix’s Los Gatos Headquarters in Silicon Valley. Today the streamer also runs offices and studios in Hollywood, New York, New Mexico, Mexico City, Toronto, London, Paris, Amsterdam, Madrid, Mumbai, Singapore, Sydney, Seoul, and Tokyo.

Since the premiere of House of Cards, for example, Netflix’s annual investment in original productions has skyrocketed from $2.4B (billion) in 2013 to $5B in 2015, $9B in 2017, $12B in 2018, and $15B in 2019 (Löffler). Last year in comparison, Disney responded by spending $24B on originals [for Disney+, Hulu, and ESPN+]; NBCUniversal $13B [for Peacock]; WarnerMedia $11B [for HBO Max]; Amazon $8.6B [for Amazon Prime Video]; and Apple $5B [for Apple TV+] (Jarvey, ‘Netflix Under Pressure,’ 52). As a result, Netflix now shares the top-tier of the streaming sector with five other major OTT media-service providers.

Today there’s no telling how many of these major players will eventually survive the shakeout in what promises to be a highly turbulent and unpredictable entertainment marketplace throughout the 2020s. Even more surprisingly, there now exists 265 other mini-major and niche online video service companies trying to make a go of it in the United States alone (Barnes).

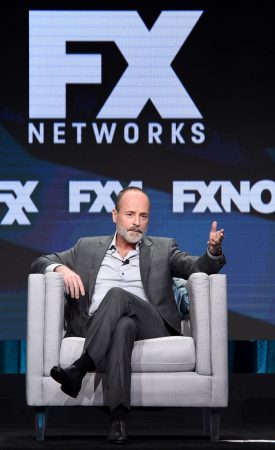

This tsunami of streaming activity is resulting in a once-in-a-lifetime shift in the entertainment landscape. Back in 2014, FX Networks CEO, John Landgraf, called this situation Peak TV, arguing that content creation in scripted television had reached a saturation point. Little did he or anyone else know at the time that the proliferation in programming was just beginning.

Fig. 2: When John Landgraf, CEO of FX Networks and Productions, coined the neologism, Peak TV, in 2014, he was referring to 389 scripted television programs that year. In 2019, the total had mushroomed to 532 and counting.

Netflix was and still is the entertainment industry’s leading digital disruptor, which created and made available to its worldwide subscribers 371 new television shows and movies in 2019, a 55% increase over its output of 240 in 2018 (Hahm). Ironically, though, Netflix’s all-things-for-all-people approach to production is leaving it more vulnerable than ever now that it has to contend with an assortment of far more distinctive and mainstream Hollywood content brands going online such as FX and AMC from the basic cable-and-satellite sector, HBO and Showtime from pay TV, CBS and NBC from broadcast television, and Disney and Warner Bros. from the movie business, among many other well-known entertainment imprints.

Moreover, the degree of convergence now brought about by streaming is having the unintended consequence of rendering the traditional ways of classifying television, video, and film platforms obsolete in the 2020s. The same TV programming and film narratives travel seamlessly across broadcast, cable-and-satellite, and OTT windows reaching a wide assortment of different viewing cohorts.

Likewise, creative content moves fluidly between multiplexes and IMAX theaters, home and mobile digital devices of all shapes and sizes. Research indicates that most contemporary audience members are not at all picky about how and where they watch their movies and TV; they merely choose the best available screen when it comes time to turn on or stream. The 2020s augur an era of radical convergence.

When Reed Hastings and his corporate colleagues rebranded Netflix in 2016 as the world’s first global film and television network, they revealed the company’s Silicon Valley roots by emphasizing above all else the company’s game-changing method of distribution and its algorithmically-based decision-making strategies, not the quality of its content.

Since 2013, Netflix has produced a few high-profile award-winning TV programs and films each year, but given the sheer tonnage of its output, celebrated examples beginning with House of Cards up through late 2019 releases, such as The Irishman (November 27) and Marriage Story (December 6), are more the exceptions rather than the rule in the streamer’s overall portfolio.

Fig. 3: Reed Hastings admitted in September 2019 that Netflix had been outbid by Amazon for the rights to Fleabag (2016-19). He in turn characterized this latest phase of the streaming war as ‘tough competition. Direct-to-consumer (customers) will have a lot of choice’ (Chu).

Netflix’s recent international push also underscores both its greatest strength and weakness. At present, it does possess the technical and financial wherewithal to deliver its online media services worldwide beyond the capabilities of any of its competitors. Aiming to initially reach 130 countries in 2016, it quickly exceeded that goal by servicing 190 today including 67.1M (million) subscribers in North America; 47.4M in Europe, the Middle East, and Africa; 29.4M in Latin America; and 14.5M in the Asia Pacific; reaching a total of 158.4M global subscribers by 30 September 2019 (Jarvey, ‘Netflix’s Subscriber Growth Story’).

Still, this healthy rise in international subscriptions masks the dramatic slowdown in new U.S. and Canadian customers, as well as in Europe, the Middle East, and Africa, even before the other major streamers save Amazon Prime Video and Hulu went online.

In addition, new streaming providers are now sprouting up all over the world to challenge Netflix from Spain to Singapore, Britain to India, Germany to Japan and China (Roxborough). Where Netflix again had another wide-open market outside North America pretty much to itself; since 2017, dozens of international streamers are currently up-and-running in every region of the globe to more directly compete for local subscribers.

With long-established Hollywood companies, such as Disney for instance, content is king and distribution is queen to resurrect the old saw. Reflecting its Silicon Valley DNA, Netflix has flipped that truism. Until recently, the streamer has gambled all on building a service that its subscribers cannot live without, rather than streams of breakout programming to die for. In fact, much of the content that Netflix firehoses at its customers is merely passable or even forgettable. No longer will it be able to get away with so much mediocrity.

Netflix overwhelms its subscribers (as well as its competitors) with too much content. A significant viewing pattern has surfaced as a result where a majority of Netflix customers marathon programming they have already seen (e.g., The Office, Friends, Grey’s Anatomy, etc.) rather than sample the ever-growing avalanche of new content; 50% of usage at the streamer is also focused on its 100 most popular titles.

Where Netflix was the hunter; it’s now the hunted. The new reality is that it has to compete with a handful of other major streamers who as of today are behind (but catching up) in terms of usability and performance of their online delivery systems and algorithmic know-how. Nevertheless, they are way ahead in respect to the scope and quality of their archival holdings and current creative output offering potential subscribers branded content they recognize and want to watch.

Considering Disney again, Disney+ not only makes available its 20th century legacy archive; it has spent the 21st century adding well-known and popular content brands, such as Pixar (25 January 2006), Marvel (31 August 2009), Lucasfilm (30 October 2012), and 21st Century Fox (19 March 2019), which includes The Simpsons, FX, and National Geographic. The ceaseless churn of mergers and acquisitions that has been pervasive throughout the entertainment industry over the past two decades is also likely to continue into the 2020s.

The central question arising from today’s burgeoning relationship between Silicon Valley and Hollywood is how will this trend eventually affect Netflix. The bottom line is this pioneering streamer is currently too big to fail. However, this forecast does not preclude the fact that the 2020s are destined to be much more challenging and transformative for Netflix than were the 2010s. Unlike its widely diversified major competitors, it has all of its eggs in the streaming basket. Besides its algorithmic treasure trove, it presently has nothing else to fall back on. Equally as important and telling, it is now swimming in $12.6B of debt (Galloway 24).

A Darwinian fallacy exists whereby industry professionals and media scholars alike reflexively frame marketplace competition in the entertainment industry as a survival of the fittest. In point of fact, the interrelated histories and developments of film and television never played out in such a simplistic and one-dimensional way. Television did not replace movies; cable-and-satellite did not supplant broadcast TV; and Silicon Valley-styled television or streaming will not usurp Hollywood.

A more complex and nuanced relationship emerged in the first two examples, where all the major players needed to adjust and retool, while a kind of convergence 2.0 is now occurring in the third instance between New Tech and Old Hollywood where the traditional firewall between them is rapidly dissolving as each side becomes more like the other. Peak TV has morphed into Plus TV where the future of Hollywood is inextricably linked with streaming as a technological, industrial, aesthetic, cultural, and consumptive practice.

One can quibble about dates and specific starting points, but it is increasingly evident that the history of television entered the TVIV stage sometime around 2013 when Netflix made its first baby steps beyond being just a distributor of television programs and films to being a content generator. This digital disruptor has exerted an outsized influence on what TV and movies have since become, while Netflix too is being dramatically remodeled in the process, having recently been the subject of takeover rumors as both a buyer (Paramount, Egyptian Theatre) and seller (Apple, Amazon).

For all of the blue-sky projections surrounding the ascendancy of streaming in the 21st century, the results for television in particular are beginning to resemble the good old days of the late 20th century rather than a continuation of the latest so-called golden or platinum age of TV, which is probably over. The present and future of television programming is increasingly resembling the just good-enough quality of its past.

There is little time for quality control at Netflix, for instance, and its extensive slate of broad-appeal often disposable shows has so far proven to be only as good as they need to be for its current business model. Still, this devolution does not mean that high-end innovative series and miniseries are no longer being made by Netflix and the other major streamers; instead, creating them is now a secondary concern, far behind keeping subscribers fully immersed within each respective media service provider’s all-inclusive ecosystem (i.e., Netflix, Amazon, Apple, Disney, Comcast, etc.).

At the same time, paradoxically, Netflix also allocates huge sums of money each year on a few select projects in order to raise its profile in Hollywood and build its credibility within the creative community by competing for major institutional awards such as Oscars, Emmys, Golden Globes, and all the major union prizes (Producers Guild of America, Screen Actors Guild, Writers Guild of America, etc.).

A case in point is the $158 million that Netflix invested in Martin Scorsese’s The Irishman in early 2017. Besides Scorsese, this star-studded project includes such Academy Award-winning actors Robert DeNiro, Al Pacino, and Joe Pesci, screenwriter Steven Zaillian and, editor Thelma Schoonmaker, among other celebrated above-the-line talent.

Fig. 4: (Left to right) Screenwriter Eric Roth (Forrest Gump [1994], The Curious Case of Benjamin Button [2008], A Star is Born [2018], etc.) interviewed Steven Zaillian (Schindler’s List [1993], Moneyball [2011], The Irishman [2019], etc.) at a special 9 November 2019 screening of The Irishman at the Writers Guild of America West in Los Angeles. Zaillian recounted how he wrote the first working draft of The Irishman’s script a decade ago and that the film only got made because of the interest and financial support of Netflix.

The outcry pro and con was immediate and hyperbolic if also short-lived. Most famously, Francis Ford Coppola, who was receiving a lifetime achievement award at the annual Lumière Festival in Lyon, France on October 18, doubled-down by declaring that ‘Martin was kind when he said it’s not cinema. He didn’t say it’s despicable, which I say it is’ (Perez).

The voices pushing back surfaced at once and were even more numerous than the MCU critics including Disney CEO Bob Iger, Marvel Studios president Kevin Feige, directors Jon Favreau, James Gunn, and Joss Whedon, as well as actors Robert Downey, Jr., Natalie Portman, and Samuel L. Jackson, among others. As a closing rejoinder, Scorsese felt compelled to pen a November 5th New York Times editorial entitled, ‘I Said Marvel Movies Aren’t Cinema. Let Me Explain.’

What is most important about the debate surrounding this media-fueled fracas is how it revisits and updates film critic André Bazin’s half-century old question, What Is Cinema? (1967, 1971). New York Times film critic, A.O. Scott, even evokes Bazin in his end-of-the-year top-ten listing entitled, ‘Films Worth Arguing About,’ when he asks while including The Irishman, ‘What is cinema? If you have three and a half hours to spare—and you do—this is a pretty good answer.’

Overall, the preeminent aesthetic consequence of the recent comingling of Silicon Valley-TV and Hollywood is that the distinction between movies and television is now more than ever becoming a moot point. Through the 21st century so far, film and TV are more legacy terms than accurate descriptors of what these converged technologies empirically are anymore in the digital age. The aforementioned responses to Scorsese’s criticism of MCU have thrown this reality into sharp relief, as has the subsequent theatrical and streamed showings of The Irishman.

Once again, National Association of Theatre Owners (NATO) chief John Fithian criticized Netflix for The Irishman’s relatively short 21-day theatrical run in November 2019, as he previously had with Roma in 2018, although his own association’s internal research concludes that streaming actually stimulates attendance at theaters rather than hurts it because ‘people who love content are watching it across platforms and all platforms have a place in consumers’ minds,’ according to Phil Contrino, director of media and research for NATO (Lang).

America’s five major film theater chains (AMC, Regal, Cinemark, Marcus, and Harkins) did boycott The Irishman, but the movie nevertheless grossed an estimated $7 million in five dozen art house cinemas throughout the United States, likely making the it Netflix’s most successful theatrical release to date.

The Irishman’s performance on the Netflix portal was even more robust. The streamer reported via CNBC that 26 million accounts accessed the 3½ hour screen narrative during its first week of availability (Sherman). This figure compares to the estimated 20 million people attending all of the movies in theaters throughout North America over the same seven-day period.

The critical response too was overwhelmingly positive earning a 96% rating across 411 reviews as posted on the online aggregator rottentomatoes.com. Some critics recommended seeing The Irishman in a theatre if possible. Other reviewers, however, such as The New Yorker’s Richard Brody, suggested ‘watching “The Irishman” on Netflix is the best way to see it.’

Ty Burr of the Boston Globe moreover christened it a ‘masterpiece’ (13 November 2019), pointing out in an earlier article that given ‘the state of the movie industry in 2019 . . . the year’s best movie was essentially made for TV’ (6 November 2019).

I created a viewing guide for everyone who thinks THE IRISHMAN is too damn long for one night. You're welcome! #scorsese #netflix #theirishman pic.twitter.com/sH06AxJ7he

— Alexander Kardelo (@dunerfors) November 28, 2019

Is The Irishman a theatrical film masquerading as a television special? Is it rather a TV miniseries à la Alexander Dunerfors Kardelo’s tongue-in-cheek tweet (above) that also had a short courtesy run in theaters? Are Disney’s MCU tentpole movies cinema? Considering the entertainment industry’s newest guiding theorem—Silicon Valley + Hollywood = Convergence 2.0—the answers must be yes, yes, and yes.

Just as this latest stage in the history and development of television requires that we rethink the way in which we classify distribution platforms; it likewise necessitates that we reconceptualize screen narratives more in line with the radical convergence of TVIV where the traditional boundaries between television and film no longer apply.

Gary R. Edgerton is Professor of Creative Media and Entertainment at Butler University. He has published twelve books and more than eighty-five essays on a variety of television, film and culture topics in a wide assortment of books, scholarly journals, and encyclopedias. He also coedits the Journal of Popular Film and Television.

Works Cited

Barnes, Brooks. ‘The Streaming Era Has Finally Arrived. Everything Is About to Change,’ New York Times. 18 November 2019 at https://nytimes.com/2019/11/18/business/media/streaming-hollywood-revolution.html.

Brody, Richard. ‘Watching “The Irishman” on Netflix Is the Best Way To See It,’ The New York Times. 2 December 2019 at https://newyorker.com/culture/the-front-row/watching-the-irishman-on-netflix-is-the-best-way-to-see-it.

Burr, Ty. ‘“The Irishman” is a Masterpiece from Martin Scorsese,’ Boston Globe. 13 November 2019 at https://bostonglobe.com/2019/11/13/arts/irishman-is-masterpiece-martin-scorsese/.

Burr, Ty. ‘What Could Be the Year’s Best Film Was Virtually Made for TV,’ Boston Globe. 6 November 2019 at https://bostonglobe.com/2019/11/06/arts/fighting-irishman/.

Bazin, André. What Is Cinema? Volume I. Translated by Hugh Gray. Berkeley and Los Angeles, CA: University of California Press, 1967.

Bazin, André. What Is Cinema? Volume II. Translated by Hugh Gray. Berkeley and Los Angeles, CA: University of California Press, 1971.

Chu, Henry. ‘Reed Hastings on the Streamer Wars: “It’s a Whole New World Starting in November,”’ Variety. 20 September 2019 at https://variety.com/2019/tv/news/reed-hastings-on-the-streamer-wars-its-a-whole-new-world-starting-in-november-1203343068/.

De Semlyen, Nick. ‘Martin Scorsese Interview,’ Empire. October 2019 at https://empireonline.com/movies/features/irishman-week-martin-scorsese-interview/.

Galloway, Stephen. ‘Hollywood’s “Terrifying” Problem: Debt,’ Hollywood Reporter. 9 October 2019: 23-24.

Hahm, Melody. ‘Eye-Popping Chart Shows How Much Original Content Netflix Is Creating,’ Yahoo Finance. 17 December 2019 at https://finance.yahoo.com/news/netflix-original-content-disney-and-apple-plus-230418533.html.

Jarvey, Natalie. ‘Netflix’s Subscriber Growth Story: Focus Overseas,’ Hollywood Reporter. 19 December 2019: 34.

____________. ‘Netflix Under Pressure,’ Hollywood Reporter. 7 August 2019: 50-53.

Lang, Brent. ‘Netflix Isn’t Killing Movie Theaters, Study Shows,’ Variety. 17 December 2018 at https://variety.com/2018/film/news/streaming-netflix-movie-theaters-1203090899/.

Löffler, Max. ‘Netflix’s Global Reach: By the Numbers,’ Hollywood Reporter. & August 2019: 63.

O’Connell, Michael. ‘Yes, I Did Say That!’ Hollywood Reporter. 25 September 2019: 46.

Perez, Lexy. ‘Francis Ford Coppola Defends Scorsese Marvel Comments, Calls Films “Despicable,”’ Hollywood Reporter. 20 October 2019 at https://hollywoodreporter.com/heat-vision/francis-ford-coppola-defends-scorsese-calls-marvel-films-despicable-1248929.

Roxborough, Scott. ‘Global Streamers Rise Up to Battle Netflix,’ Hollywood Reporter. 3 April 2019: 34-35.

Scorsese, Martin. ‘I Said Marvel Movies Aren’t Cinema. Let Me Explain,’ New York Times. 5 November 2019: AR27.

Scott, A.O. ‘Films Worth Arguing About,’ New York Times. 8 December 2019: AR19.

Sherman, Alex. ‘More than 26 Million Netflix Subscribers Viewed “The Irishman” in Seven Days, Chief Content Officer Says,’ CNBC. 10 December 2019 at https://cnbc.com/2019/12/10/netflixs-irishman-ratings-26-million-subscribers-watched-first-week.html.

Gary R. Edgerton is Professor of Creative Media and Entertainment at Butler University. He has published twelve books and more than eighty-five essays on a variety of television, film and culture topics in a wide assortment of books, scholarly journals, and encyclopedias. He also coedits the Journal of Popular Film and Television.

What a brilliant read Gary! So much in here that I’ve found informative and thought-provoking. Your rumination “Is ‘The Irishman’ a theatrical film masquerading as a television special?” chimes with some debates that I’ve been having with myself recently regarding the advent of the US network TV movie in the 1960s and how I need to classify and approach them for some research of my own. Do I ignore and deny their effect on “pure” television series, or embrace them despite them being very different to traditional strands – and not quite the same as a cinematic venture being carried subsequently on the small screen after a sojourn on the big.

But – on a wider basis – learning about this entire universe of new product is very useful for me as somebody who – in the UK – has never watched anything other than free-to-air channels. And – frankly – I have a devil of a job keeping up with them “(Shakespeare & Hathaway” returns to BBC One next week in a stripped slot, so that’s 45 minutes of each evening gone with some blissful Warwickshire hokum… and we’ve only just caught up the similarly scheduled exploits of “Father Brown”).

And it’s so weird reading about the shows on these platforms with the same sensation I had decades ago – stuff I read about, but can’t see. I’m finally enjoying “Good Omens” which has now dropped (as the kids say) on BBC Two some months after the rest of the world were tapping their toes to David Arnold’s brilliant music score. The last week has been packed with “Picard” as my more tech-savvy 21st Century friends tell me about Jean-Luc’s latest phase of life. I’m hoping that somebody like E4 will eventually pick it up… but at the moment this reminds me of September 1983 all over again; I can see from the national newspaper listings that Central having picked up “kolchak: the night stalker” (which I’ve wanted to see for *years*) in a late-night Saturday slot… but, sadly, I happen to be living in the northern part of the Yorkshire region, and the midlands signal just won’t reach that far. Anyway, I waited a few years and in 1991 that nice Mr Richard O’Brien showed them on BBC Two as part of “Night Train”. Hoorah!

So, as an outsider to what’s happening with all this “on demand” material – this lovely piece is a real eye-opener to me and, as a viewer, I’m trying to make my own comparison on a rather antiquated bases.

But fascinating stuff. Many many thanks! 🙂

All the best

Andrew